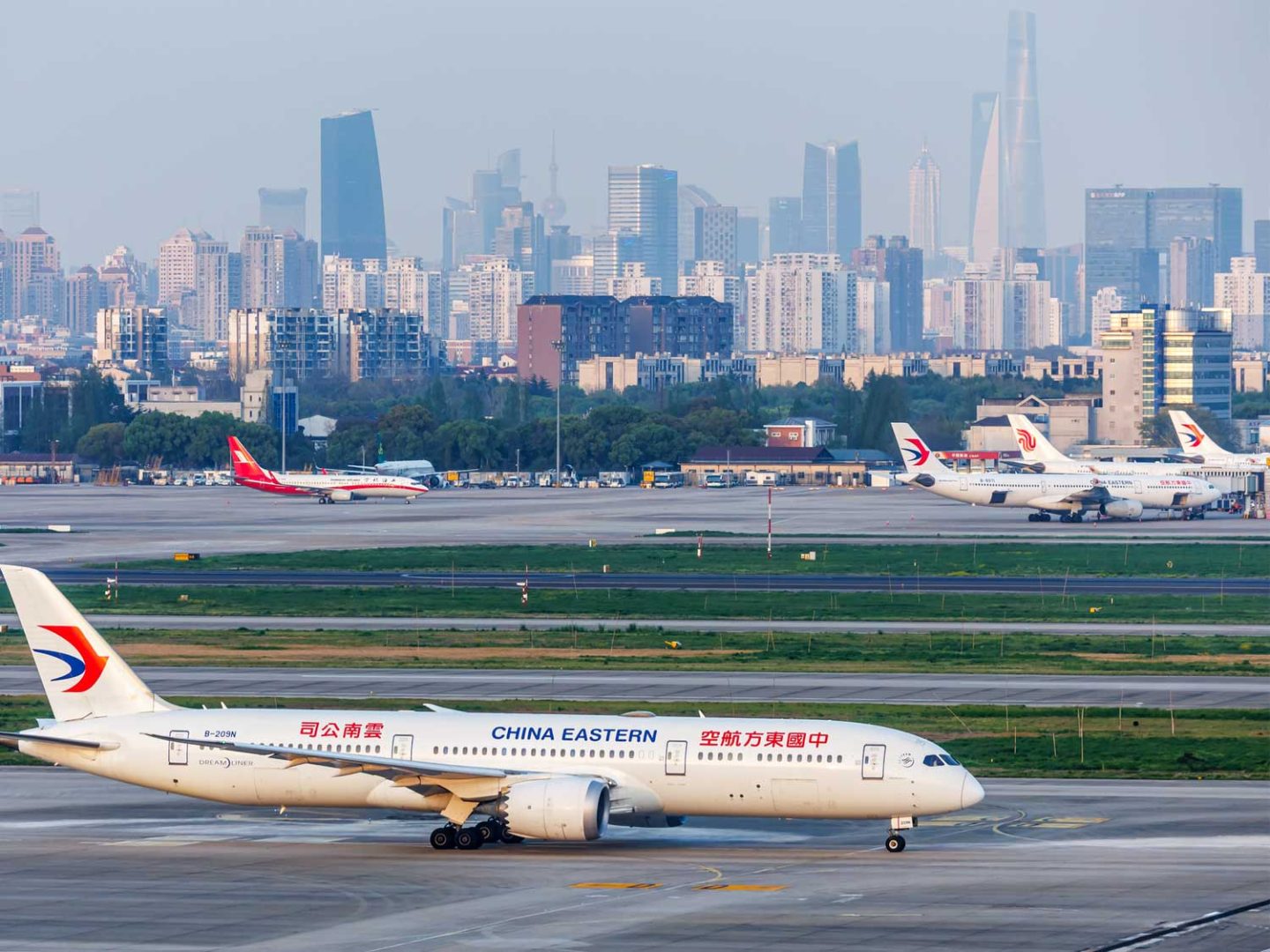

For shippers moving goods by air into Europe and the US, the peak season has arrived with a complexity not seen in recent years. As flights are cancelled and rates trend sharply upward, a fundamental reshaping of the marketplace is underway.

In September, a powerful typhoon swept through southern China just as the annual Golden Week holiday loomed. Traditionally, Golden Week brings a slowdown as manufacturing pauses and workers take leave, creating ripples in cargo flow.

This year, the typhoon compounded the crisis: hundreds of flights were suspended and key export ports shuttered, abruptly tightening airfreight supply. Airport terminals saw mounting backlogs, with some shipments delayed by nearly a week before normal operations could resume.

The squeeze led to dramatic, double-digit percentage increases in airfreight rates for shipments from China to Europe, climbing between 30% and 50% compared to average off-season levels. Routes to the United States also saw significant jumps, though the impact was mitigated by shifting demand patterns and new import restrictions in the US.

Europe Bound: A Market in Flux

While every major trade lane felt the impact of these disruptions, the China-to-Europe corridor has emerged as both the most stressed and the most resilient. Demand for space surged as volumes, particularly of high-tech and eCommerce goods, outpaced declining US-bound shipments.

This pattern reflects a broader structural change: capacity typically serving transpacific markets is now being redirected to European routes, reinforcing the upward pressure on rates.

The European Union’s relative trade stability and ongoing restocking by retailers have kept import flows buoyant. In contrast, the US market is seeing smaller volume growth and increasingly complex customs checks, which have led to sporadic diversions of supply chains to alternative gateway countries and slower overall throughput.

US Adjustments and Alternative Strategies

The US airfreight market from China, though still sizeable, has shifted course under the weight of new regulatory developments. The end of duty-free de minimis rules has decreased the viability of direct eCommerce shipments for small parcels.

As a result, shippers have begun to favour indirect strategies, routing goods through third countries to manage duties, or utilising other North American hubs to avoid new tariff thresholds.

This has prompted a measurable contraction in direct air cargo volumes to the US from China, even as some businesses attempt to hedge risk by booking additional capacity in advance for the holiday season. Leading carriers report rates holding steady or growing only modestly compared to Europe-bound lanes.

The Road (Skies) Ahead

Looking through 2025’s peak season and into the coming year, the airfreight market faces continued unpredictability. Recovery from typhoon-related disruptions is expected to be gradual, with many factories extending their Golden Week closures and logistical bottlenecks possibly persisting into mid-October.

Industry analysts project that rates on China-Europe flights are likely to rise further by up to 10% before normalising, while transpacific pricing will remain highly sensitive to evolving US trade policy and inventory cycles.

At the same time, underlying trends, such as the shift of high-value tech goods via air and the migration of eCommerce flows through alternative channels, suggest that unpredictability will remain a defining feature.

Early communication is becoming indispensable for urgent shipments. We would encourage shippers to forecast and book well in advance, providing transparent communication about possible route or schedule changes, and retain contingency plans for the likely rolling pockets of disruption.

Metro gives you the visibility, agility, and expertise to overcome turbulence and transformation, strengthening your supply chain and securing your airfreight movements from China to the US and Europe.

With demand surging and carrier schedules in flux, securing space and certainty has never been more critical. Metro is actively monitoring capacity, adjusting routings, and working with trusted carrier partners to protect booking allocations.

Our latest innovation takes visibility and control to new levels, with real-time flight telemetry tracking to provide:

– Live aircraft position and route mapping

– Accurate departure and arrival confirmation

– Time-stamped milestone events, updated in real time

This level of transparency means you can plan confidently, optimise inventory, and protect service levels even in unpredictable conditions.

Partner with Metro for smarter, faster, and more resilient air freight solutions, powered by live data and long-standing carrier relationships.

EMAIL Andrew Smith, Managing Director, today to explore how we can support your success.