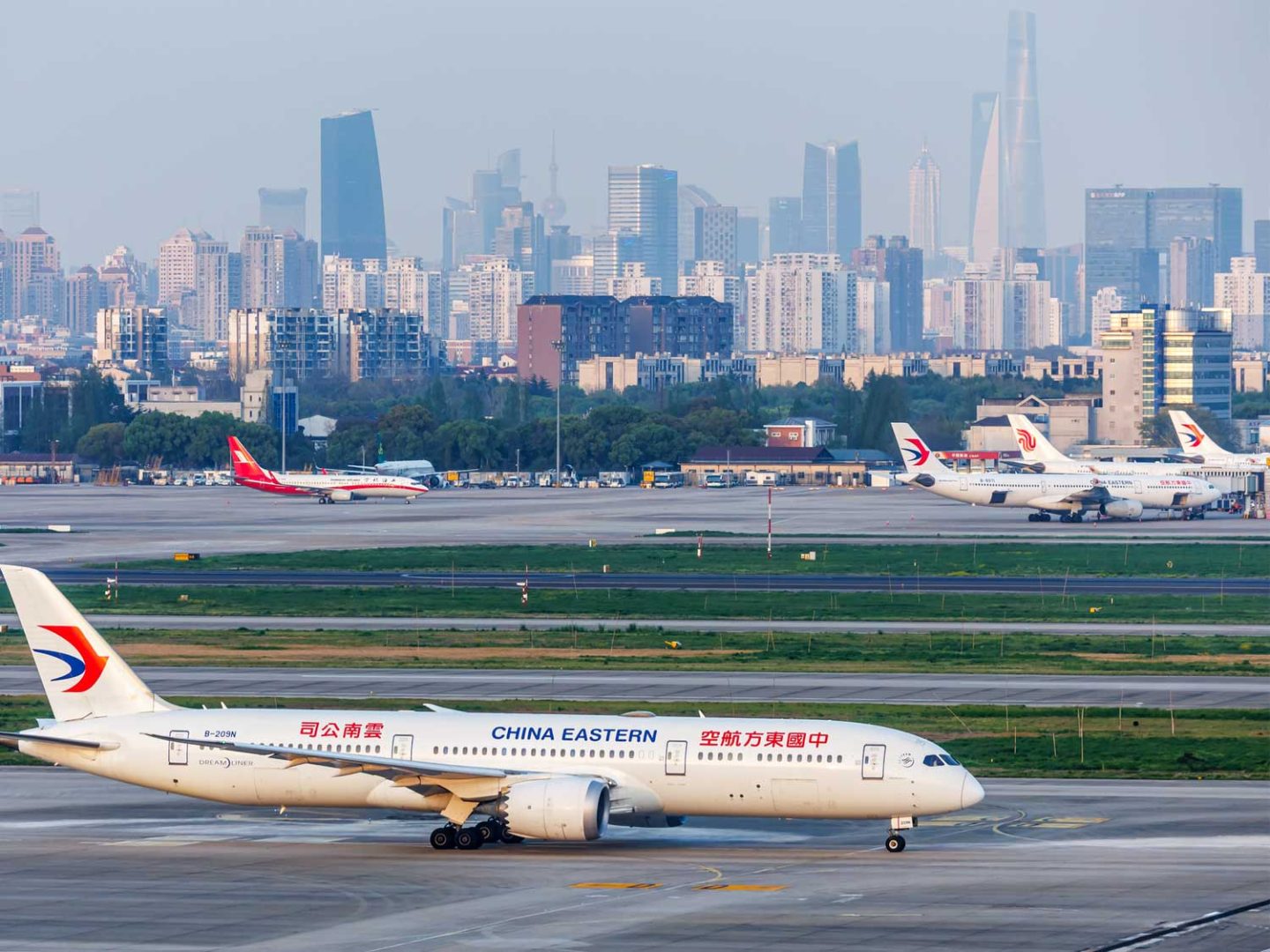

Container lines are tightening capacity to defend freight rates just as new U.S. port fees on China vessels start on 14 October—costs that carriers say will be passed through to shippers.

In the run-up to contracting season, the shipping alliances have stepped up blank sailings to support pricing. Between weeks 42–46, carriers withdrew 41 of 716 planned east–west sailings with the heaviest cuts on the transpacific and Asia–Europe corridors. It means that 6% of capacity, or 544,000 TEU have been stripped from transpacific and Asia–Europe trade-lanes over the past four weeks.

Spot rates remain soft, with Drewry’s composite World Container Index dipping 1% in week 41, as carriers signal fresh GRIs of up to $2,300/teu and congestion/peak surcharges as they curb supply with voids and slow steaming.

USTR port fees are active

From 14 October, the United States is imposing USTR “special port service fees” on China-linked tonnage, with payment required in advance of arrival to avoid being denied lading, unlading or clearance.

For Chinese-owned/operated vessels, the fee starts at $50 per net ton, stepping up annually to 2028. For Chinese-built ships (not China-operated), the fee is the higher of $18 per net ton or $120 per discharged container, while foreign-built vehicle carriers face $46 per net ton from today.

What it means for shippers

- The USTR regime adds a new fixed cost per container on top of base ocean rates and surcharges, and carriers are preparing pass-throughs.

- With 6% of departures already pulled on main east–west trades and more voids likely, load factors are rising on the sailings that remain, which will add upward price pressure.

- U.S. rules emphasise USTR pre-payment and proof on arrival, with non-compliance risks of port denial, cascading delays to inland supply chains and additional cost.

The container shipping lines are using their capacity and surcharge levers to prop up rates, while the USTR/China port fees, effective from last Tuesday, inject a non-market cost that will filter through to shippers. Expect more targeted blanks, GRIs with short notice, and more surcharges on Asia–Europe and transpacific flows into November.

At Metro, we work hand-in-hand with our network and carrier partners to keep cargo moving, even when the market is disrupted.

From time-sensitive shipments to sudden blankings, our sea freight team secure the right space to safeguard your supply chains and shield you from GRIs.

EMAIL Andrew Smith, Managing Director, today to explore how we can protect your US supply chains and insulate you from threatened GRIs.