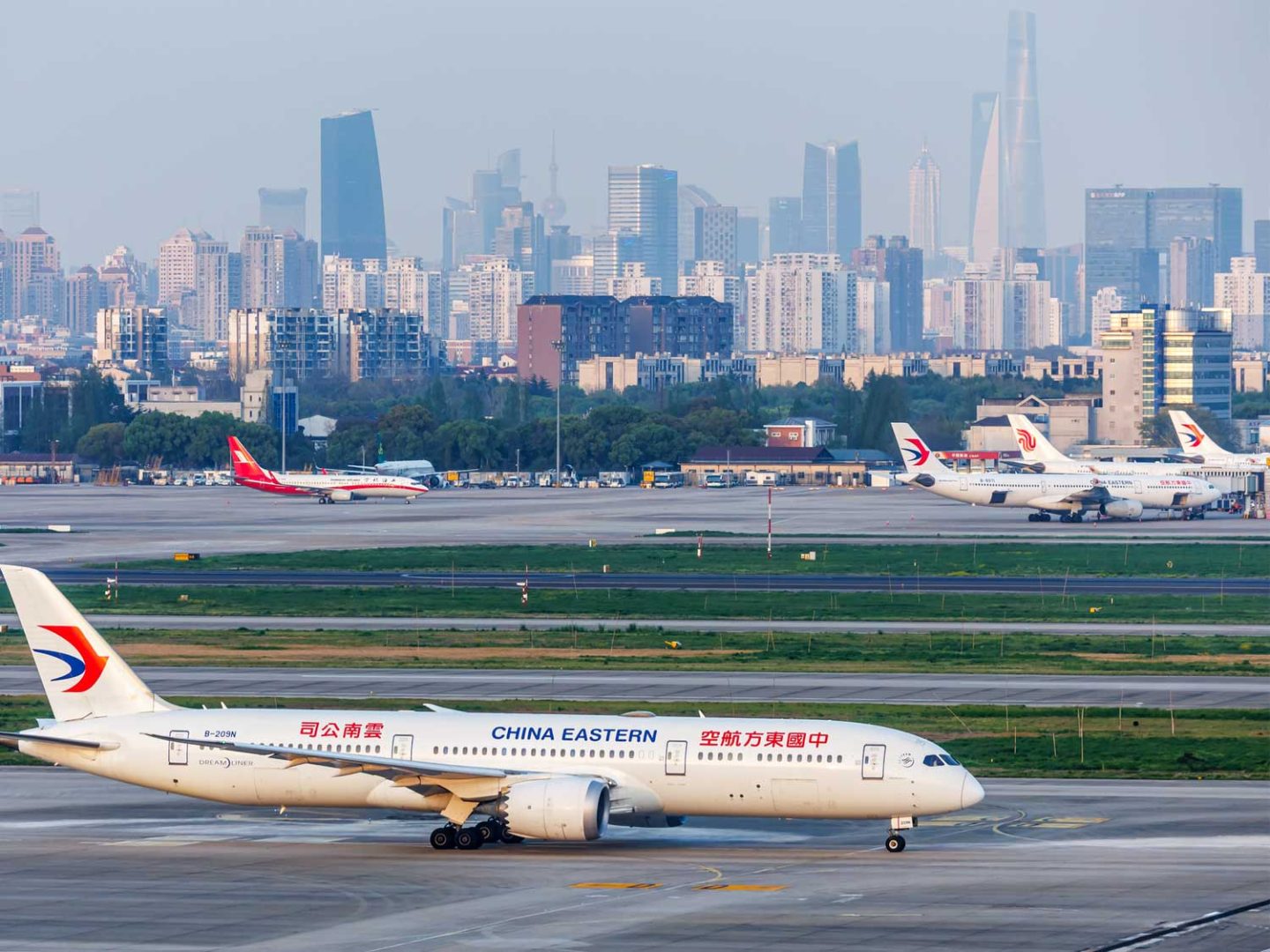

Shippers moving goods out of Asia are bracing for the tightest space and schedule disruptions as the major container shipping lines accelerate blank sailings in the lead-up to China’s extended Golden Week holidays.

Following weeks of tentative planning, lines have now confirmed broad capacity withdrawals, cancelling between 14–17% of sailings on core Asia–Europe and Asia–US routes to offset softer demand amid seasonal and weather challenges.

The unprecedented combination of Golden Week and the Mid-Autumn Festival has pushed factory shutdowns to an eight-day stretch this year, pausing exports at the world’s manufacturing hub.

Just days before the holiday, Super Typhoon Ragasa hammered South China, triggering port closures, flight cancellations, and severe equipment shortages. Local experts now expect cargo backlogs and shipping delays to stack up for at least a week beyond the holiday’s official end, intensifying the regional congestion and supply chain volatility.

Carrier Alliances Adjust Rapidly

Analysis of carrier announcements reveals distinct strategies among the largest ocean alliances. Early movers blanked sailings soon after market signals softened, while others opted for aggressive, late-stage cuts in the final pre-holiday weeks. Whether by steady withdrawals or front-loaded cancellations, overall capacity reductions are now on par with historical Golden Week patterns, yet the scale and timing of adjustments this year dwarf previous years and reflect the urgent need for carriers to rebalance supply with dampened demand.

In parallel with capacity cuts, carriers are moving to restore profitability through new general rate increases (GRIs). One major line has announced GRIs effective from early October:

- Far East–North Europe: $1,200 per 20ft and $2,000 per 40ft.

- Far East–West Mediterranean: $1,750 per 20ft and $2,500 per 40ft.

- Far East–East Mediterranean: $1,800–$2,150 per 20ft and $2,600–$2,700 per 40ft, depending on destination.

Meanwhile, another leading carrier has confirmed a peak season surcharge on the westbound transatlantic, at $400 per 20ft and $600 per 40ft.

These surcharges highlight how quickly pricing can swing when capacity is withheld and seasonal demand shifts.

Adding to the disruption, last week’s Typhoon Ragasa forced widespread factory closures and halted container movements across South China. Surges in trucking and equipment charges at origin have been exacerbated by the post-typhoon scramble.

Why Carriers Blank Sailings

Blank sailings, a carrier’s decision to skip or cancel specific port calls, or even entire voyages, are a crucial tool for controlling costs and freight market stability. These cancellations can occur due to falling demand, port congestion, storms, mechanical breakdowns, or as part of a calculated strategy to support freight rates in an oversupplied market.

Blank sailings happen for several reasons:

- Low demand – such as after Chinese New Year or Golden Week.

- Port congestion – strikes, bottlenecks, or canal delays.

- Weather disruptions – storms or unsafe docking conditions.

- Mechanical issues – urgent vessel repairs.

- Market strategy – cutting supply to stabilise freight rates.

- Regulatory or political disruption – new rules or regional instability.

The Shipper’s Challenge

Blank sailings mean longer lead times, unpredictable offloads, and more frequent cargo rollovers. Freight may get rerouted, remain at origin for extended periods, or be consolidated on later vessels, driving both and planning complexity up.

To keep shipments moving and mitigate delays, shippers should:

- Build more time buffers into supply chain schedules during holiday and storm periods.

- Use tracking and analytics tools for early indications of disruption.

- Diversify carriers, prioritising reliability and fast rerouting capabilities.

- Communicate proactively about possible delivery delays.

- Explore alternative transport modes for urgent consignments.

With volumes likely to stay subdued until the seasonal year-end surge, further blank sailings could be triggered in response to lingering congestion and uneven recovery.

The weeks ahead demand vigilance, agility, and close collaboration.

At Metro, we work hand-in-hand with our network and carrier partners across China to keep your cargo moving, even when the market is disrupted. From time-sensitive shipments to sudden blankings, our sea freight team finds the capacity and alternative solutions you need.

By sharing forecasts on critical dates and volumes, you’ll help us secure the right space to safeguard your supply chains and shield you from looming GRIs.

EMAIL Andrew Smith, Managing Director, today to explore how we can protect your ex-Asia supply chains and insulate you from threatened GRIs.