The UK road freight market is facing severe pressures from rising operational expenses and ongoing labour shortages, with Q3 rates surging 10% year-on-year, reflecting widespread cost increases.

This tough economic climate has led to the failure of nearly half of all haulage companies launched between 2019 and 2023, with fierce competition and volatile costs proving too much for smaller operators. Over 50,000 firms have exited the market, particularly in the container freight sector, with many drivers moving to alternative industries.

The failures of these smaller firms have opened the door to consolidation within the market. One of the most significant moves is MSC’s acquisition of Maritime Transport, the UK’s largest haulier. Maritime Transport operates a fleet of 1,600 trucks and has a significant presence at major UK ports.

MSC’s acquisition is part of a wider strategy to consolidate control of overland logistics throughout Europe and is likely to raise concerns among other shipping lines, potentially reshaping customer relationships in the industry.

Simultaneously, hauliers are dealing with significant challenges at UK ports. While DP World’s £1bn development of new berths at London Gateway is progressing, there are continuing political tensions between the operator and UK government officials.

Construction of two new berths will go ahead as part of a long-term plan to make London Gateway the UK’s largest container port, potentially handling six ultra-large container vessels simultaneously by the end of the decade. This expansion will significantly increase capacity and create around 400 new jobs.

Elsewhere, other UK ports are facing infrastructure delays, which are putting essential development projects at risk. The British Ports Association (BPA) has raised concerns over the backlog of harbour orders that ports require to make infrastructure upgrades and expand capacity. These delays threaten billions of pounds in investment and the ability of ports to meet growing trade demands. The situation is particularly dire for ports like Southampton and Plymouth, which have been waiting years for regulatory approvals to begin critical development work.

As the road freight industry faces these mounting pressures, larger operators are increasingly consolidating power while smaller firms struggle to survive.

The efficiency of the haulage sector remains dependent on the performance and expansion of the UK’s key ports, where delays and congestion could have far-reaching implications for supply chain resilience.

Metro offers secure road transport solutions with dedicated vehicles running on fixed routes, ensuring timely deliveries and GPS tracking for full visibility across the UK and continental Europe.

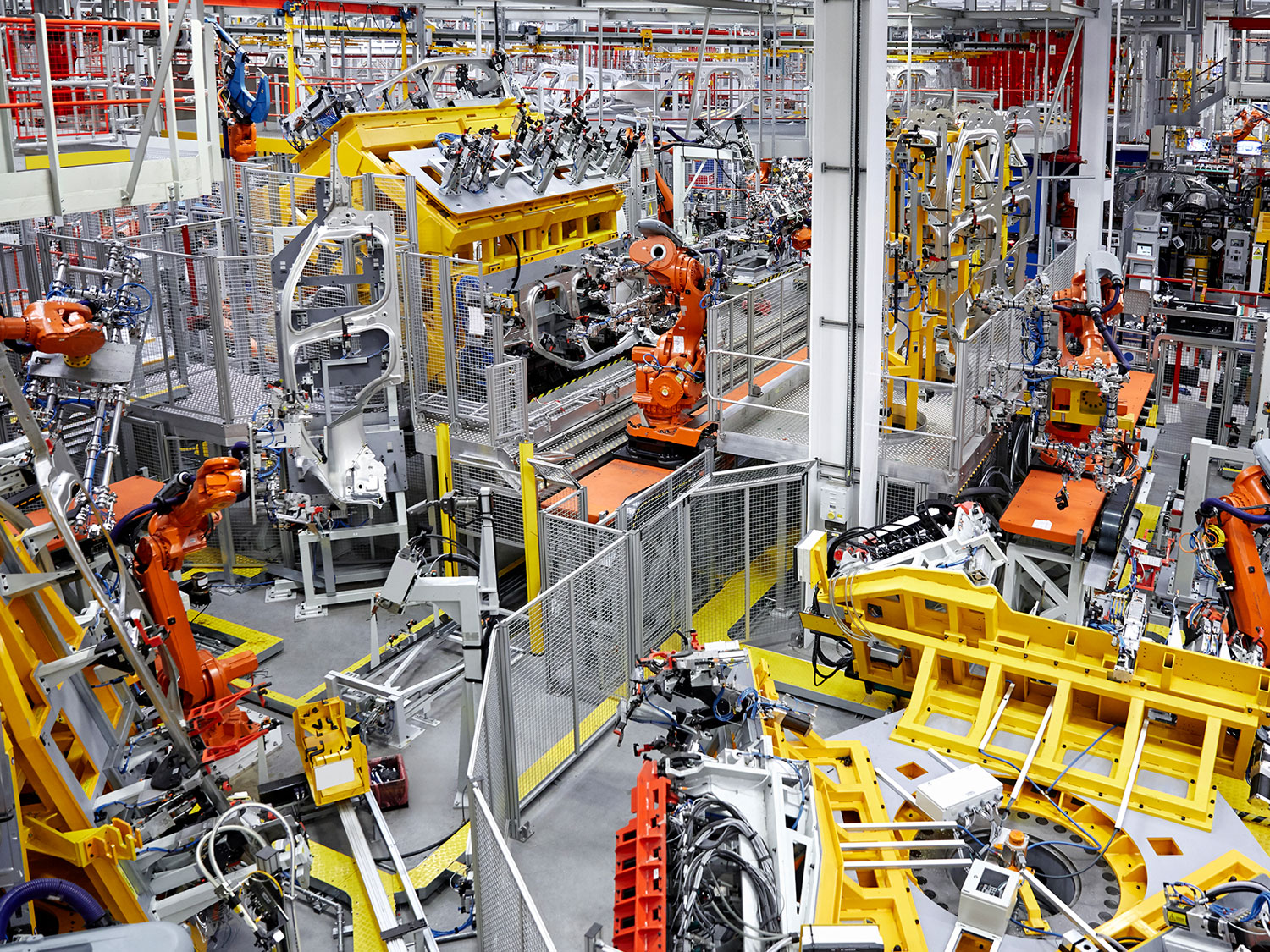

Our road freight teams are strategically located near major manufacturing and transport hubs throughout the UK, enabling efficient logistics support.

To learn more about our domestic and European services, please EMAIL Richard Gibbs to start a discussion tailored to your specific needs.